UAE has established itself as the investment hub for foreign investors as well as budding entrepreneurs. UAE’s strategic location complimented with straightforward-investor friendly trading policies has made it a hot hub for trading. Located just 8 hrs away for two-thirds of the world’s population has also ensured a strong link between Europe, Asia, Africa.

UAE has taken a massive stride since 1971, when oil contributed to 90% of the country’s total GDP. In 2021, Oil and Gas contributed to 30% of the GDP, while wholesale & retail and financial services contributed 22.7% and 11.9 respectively in the first quarter according to data shared on Statistica . Other main contributors are transport & storage, manufacturing and real estate.

There are 2 types of trading internal and external; internal trade includes retail & wholesale while external trade includes imports & exports.

There are 4 types of trading licenses you can obtain: general trading license, commercial license, industrial license and professional license. If you plan to sell any commercial goods or if you want to setup a brokerage/real-estate services then you should consider a commercial license.

If you want to set up a manufacturing unit then they will opt for industrial license. If you’re planning for a service-based business you will opt for professional license.

If you want to set up a business in a particular industry then you should opt for one of the above licenses. The UAE’s general trading license allows you to trade multiple goods under a single license. Also, the general trading license is far more expensive than the other licenses.

With implementation of the New CCL law, that allows UAE non-nationals to own 100% of the company from the previous law which mandates 51% ownership by UAE nationals, there is optimal opportunity for offshore investors to explore in the UAE market.

UAEs mainly exports to Saudi Arabia (13%), India (14%) Iran (11%) & Switzerland (5.9%) respectively, according to the United Nations COMTRADE database.

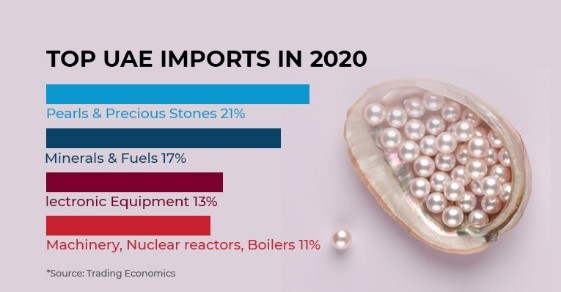

UAEs main import partners are China (18%), United States (7.7%), India (7.7%), and Japan (4.4%).

Japan and UAE are long time partners and have a $22.4 billion bilateral trade in 2020, while exports from Japan to the UAE were pegged at $5.7 billion and imports from the UAE to Japan were worth $16.7 billion, according to Gulf Today.

The consumer credit in the UAE increased to 339770 AED Million in the second quarter of 2021 from 333882 AED Million in the first quarter of 2021, which indicates an increase in the consumer consumption and signals positive weather for the traders.

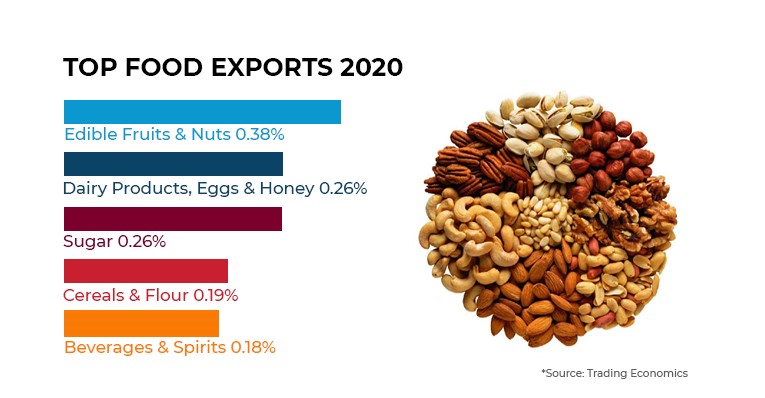

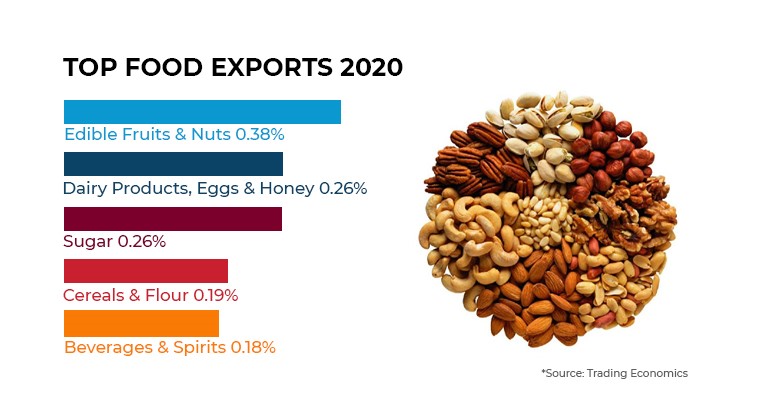

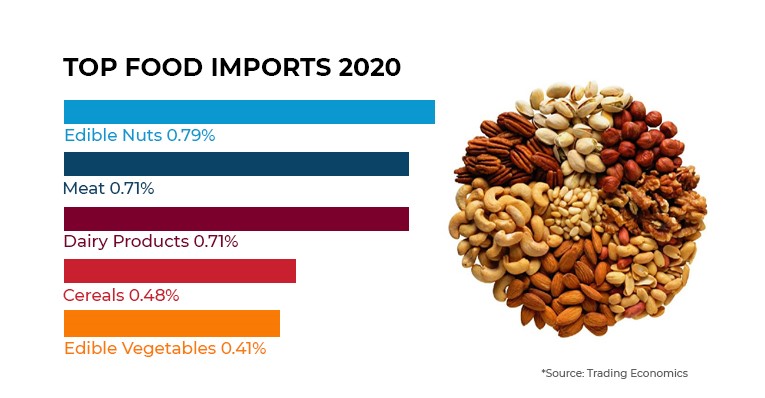

The F&B industry promises massive opportunities with exports in F&B sector in Dubai witnessing 27.8% growth in 2020 compared to the previous year despite COVID-crisis. Also, Dubai achieved a whooping 90.7% growth in the F&B sector exports and 73.1% in re-exports in first half of 2021 compared to the same period in 2020. The sector contributed to a 6.1% in the non-oil trade as per news from Dubai Industries & Exports (Dubai IE)

UAEs F&B trade hit a $20 billion in the first 9 months of 2021. Moreover from 2011 to 2020, UAEs F&B imports, exports and re-exports grew at 0.6%, 7.5% and 6% respectively per reports by Government of Dubai.

Another industry that is growing at an unprecedented rate is fashion, which is predicted to grow at an annual rate of 9.92%.

Fashion industry is primarily dominated by 3 segments; apparel, accessories, and footwear; apparel segment contributing to a lion’s share of the fashion industry. While in 2021 online sales stood at 41.5% and offline sales stood at 58.5%, there was a sudden surge in online sales due to COVID whereas in 2022 it is predicted that online sales will stand at 39.4% and offline sales is seen to gain traction and stand at 60.6%

The 25-34 years old contribute a 45.4% & 35-44 year old contribute a 28.9% and retain as the top most contributors to the fashion industry.

Internet penetration rate in UAE and Saudi Arabia stand at 99 and 89 percent respectively, compared to just 57 percent in China. Also, the recent relaxation of dress code rules in Saudi Arabia is expected to disrupt how women consume fashion in South Arabia.

E-commerce penetration is expected to increase to 9% from the current 2% in the next 5 years.

In sync with Dubai’s vision to hit a Dh 2 trillion in non-oil trade by 2025, the Dubai International Trade Roadmap plans to expand its current network of more than 400 cities around the world with 200 more cities.

The New GCC law that allows foreigners to own 100% of the offshore company complemented by Dubai International Chamber adoption to a new strategy that aims to attract 50 MNCs within 3 years and promote 100 Dubai-based companies to priority foreign markets within 2 years UAEs has positioned itself strongly as one of the top global players.

With right business plan and awareness about the constantly changing UAE trade laws and policies, UAE’s trade market promises endless possibilities and growth.

For any queries with regards to business licensing and incorporation, legal & compliance you can visit https://jupiterbusinessmentors.com/ and book a free call with our specialists.