How the world eats is changing dramatically. A decade ago, a quality time with family and friends meant mostly pizza or Chinese food but now quality time and meal could translate to favorite food from your favorite restaurant at home too. Food aggregators have not just transformed the ease of procuring of favorite food or healthy food but also disrupted the F&B industry in an unprecedented way. Little did we imagine the food delivery market will have a global market more than $150 billion; having more than tripled since 2017.

The UAE (especially Dubai and Abu Dhabi) has established itself as a “go-to” market for brands for chefs, operators, and business owners. UAE has observed an increased penetration of technology, acceptance of online food industry, and positive buying habits compared to other GCCs.

UAE consumers tend to order food from mobile apps as compared to websites. The online spending on food & drinks is recorded at AED 161 per capita. Also, another interesting insight is that change in food prices have not influenced brand switching among both emirates and non-emirates.

The 2020 pandemic has resulted in some dramatic shift in the food delivery industry. There was a whopping 13% increase in aggregator to customer delivery, which stood at 39% and restaurant to consumer delivery increased by 11% and stood at 22%.

Source: Statista

The food service market in UAE is predicted to grow at a rate of 5.22% between 2021 and 2026.

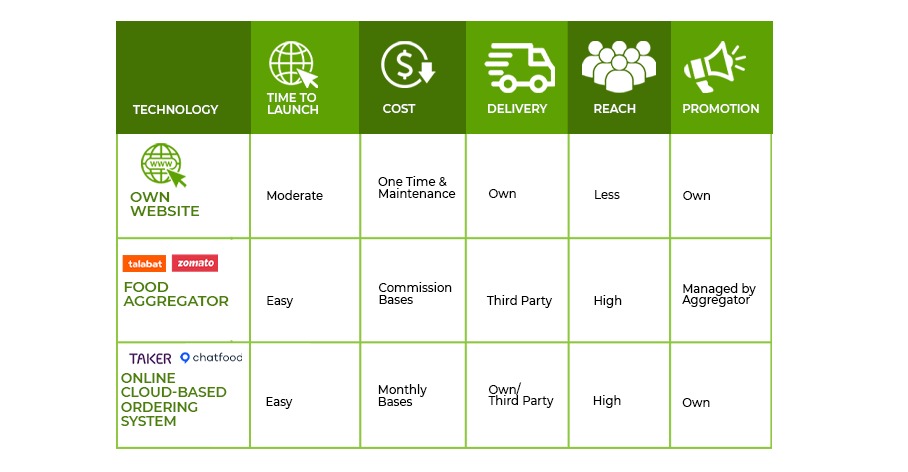

Most restaurants opt for own website, food aggregators or online order cloud-based ordering taking system to set up their online orders.

You can build your own website using a website builder or WordPress, set up deliveries and payments, then launch your site. Ironically, the biggest advantage and drawback is that while you can customize the entire system according to your needs but the responsibility of making payments to organizing deliveries rests on the restaurant owner.

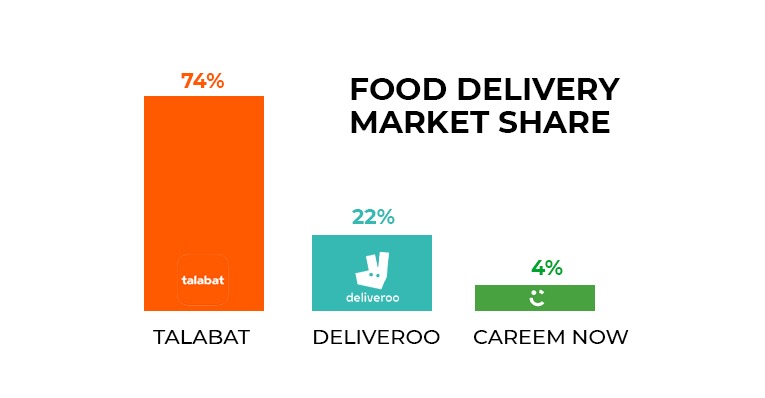

Food-aggregator apps host innumerable restaurants on their platforms. The business receives high visibility and delivery is managed by the aggregator, and they charge a high commission of 28-35% commission for each order. Some popular food aggregators in UAE include Talabat, Zomato, Noon, Careem etc.

In order to avoid high commissions charged by the food aggregators, restaurants tend to opt for hybrid delivery process. In this model, restaurants run their own online ordering platform but use a third-party company for delivery. Some popular online ordering applications are ChatFood, Taker, Zyda etc.

Let’s look at the key differences between the three online ordering technologies.

Food delivery services are rapidly outdoing restaurant sales, and it is predicted in 2023 delivery sales will grow 3% faster than restaurant sales owing to a shift in consumer giving an exceeding preference to online ordering. The delivery sector has become crucial for survival in the restaurant industry.

According to Abu Dhabi SME Hub interview, one of the biggest challenges was to manually input orders from multiple food delivery platforms and online ordering systems, which can be dealt with optimizing delivery management and integrating online sales channels with a restaurant’s POS (point-of-sale) system.

Another challenge is also managing different menus on different platforms, which can be dealt with by leveraging on the menu builder offered by FoodTech platforms that enables restaurants to easily build their menu and push it live on multiple delivery platforms for multiple locations.

Going forward, the food-delivery space is poised for further expansion and food aggregators will continue to evolve. Restaurants need to adapt their strategies, think carefully about how to partner with delivery platforms, and experiment with new ways of doing business.

Delivery platforms also have evolved on how they leverage customer data to improve the user experience and find innovative ways to reduce the costs associated with delivery due to fierce competition and changing trends.

For restaurant owners, it is crucial to stay up to date with the latest and most efficient food-tech platforms to cope up with stiff competition and stay steer ahead balancing between dine-in and deliveries.